GRESB and me

I’m Katherine, and I am the sustainability and energy performance intern at Eskew+Dumez+Ripple this fall. I am currently pursuing my master’s degree in Sustainable Real Estate Development at Tulane University, and have a background in sustainable and affordable residential construction. I love adaptive reuse, equitable development, environmental responsibility, and farm fresh produce. Enough about me, let’s talk about GRESB.

When investors are looking to invest in properties that are better for the environment, GRESB is able to connect investors to real estate holdings and their specific sustainability performance. That's why it was created, to fill that gap.

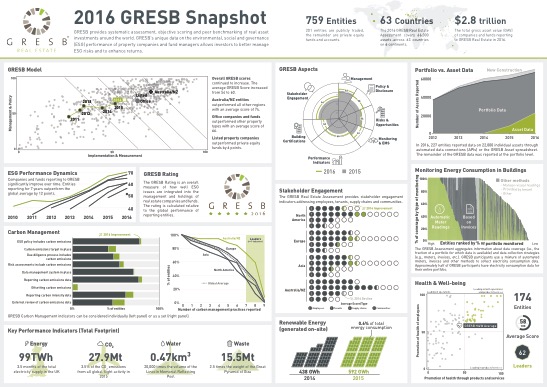

The Global Real Estate Sustainability Benchmark (GRESB), started in 2009, is a platform to quantify and rate the sustainability performance of real estate portfolios around the world. This is not a certification (like LEED), but it is a rating system, structured into seven unique sustainability aspects, to provide investors tools to accurately monitor and manage the sustainability risks of real estate and infrastructure investments, and prepare for increasingly rigorous environmental, social and governance obligations. GRESB utilizes a sophisticated infrastructure to collect detailed portfolio information, perform statistical analysis, and deliver the annual findings.

Many of us understand simply that green buildings are healthier for the environment and their occupants. But they also net higher rents, higher occupancy rates and higher prices when sold. GRESB is a global platform to accelerate market transformation because its provides the tools to investors to address sustainability performance at the portfolio level.

You may be asking yourself, “why would investor information and real estate surveys be important to me?”

If you are an architect, designer or builder, this information is essential to our work. GRESB allows us as sustainability-minded designers, to make the business case for green development. It fills the information gap between the environmental, economic, and social case for sustainable building and their financial benefit. To see what I mean, check out its yearly survey that highlights the improved asset performance of green buildings. This type of data may even cause the real estate industry to push us towards this type of development, which would be a welcome change.

Since GRESB began in 2009, carbon emissions from the real estate sector have significantly reduced, demonstrating the power of benchmarking funds on sustainability*.

"Sustainability is often viewed as an altruistic issue, but it needs to be more of a valuation discussion. At the end of the day its all about economics. The market wants to reduce energy costs and to improve asset performance; information need to be visible to the markets." -Nils Kok CEO of GRESB